More than 4 million advertisers are now utilizing Meta’s generative AI tools, which include image, video, and text generation capabilities. This growing adoption underscores the increasing role of artificial intelligence in shaping digital advertising strategies.

Dive Brief:

Meta Platforms reported a significant revenue increase of 21% year over year, reaching $48.39 billion in Q4, according to its latest earnings statement. The results exceeded analysts’ expectations and signaled strong financial performance despite the company’s ongoing investments in artificial intelligence infrastructure, which are expected to be substantial in the coming year.

The total ad impressions delivered across Meta’s suite of applications, including Facebook and Instagram, grew by 6% in the fourth quarter. Simultaneously, the average price per ad surged by 14%, reflecting stronger advertiser demand and improved targeting capabilities. Chief Financial Officer Susan Li noted that cost per thousand impressions (CPMs) is likely to continue rising as Meta enhances the precision of its ad targeting, leading to higher conversion rates.

Dive Insight:

Meta’s Q4 2024 earnings report highlighted the continued momentum of its core advertising business, driven in large part by a significant increase in ad pricing. The 14% rise in the average price per ad occurred during the crucial holiday shopping season, a period when digital advertising demand typically peaks. Over the past few years, Meta has worked to balance the introduction of newer, lower-monetizing formats—such as short-form video Reels—with advancements in the efficiency of mature ad placements.

One notable development was the expansion of advertising to Threads, Meta’s micro-blogging platform that directly competes with Elon Musk’s X (formerly Twitter). However, company executives do not anticipate that Threads’ ad revenue will meaningfully impact the company’s overall earnings in 2025.

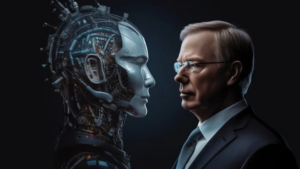

The strong financial results come amid heightened scrutiny and media attention surrounding Meta’s recent actions, including CEO Mark Zuckerberg’s evolving relationship with former President Donald Trump, the company’s reduced emphasis on fact-checking initiatives, and the emergence of DeepSeek, a Chinese generative AI platform that presents a new competitive challenge to U.S.-based AI firms like OpenAI. While some industry observers have raised concerns over Meta’s retreat from fact-checking, there has been no significant decline in advertiser interest.

“From an ad revenue perspective, Meta dominated Q4 by pulling in considerably more revenue than any other quarter in the last two years,” said Mike Proulx, Vice President and Research Director at Forrester, in an emailed statement. “The big question is whether advertisers will stick with Meta in Q1 amid growing brand safety concerns. While they might not like some of Meta’s recent decisions, they will continue to spend due to the platform’s unparalleled reach and effectiveness.”

Meta has positioned itself as a leader in generative AI development, emphasizing open-source technology that other developers can integrate into their models. This approach has both opportunities and risks, as seen with DeepSeek, which leveraged Meta’s open-source AI to build its own competing platform. Despite this, Zuckerberg remains optimistic about the benefits of open-source collaboration.

“I think there’s a number of novel things that [DeepSeek] did that we’re still digesting … they have advances that we will hope to implement in our systems,” Zuckerberg said during an earnings call with analysts. He has repeatedly emphasized that 2025 will be a “defining” year for artificial intelligence, regardless of competition from Chinese firms.

Investment in AI and Growing Adoption:

Meta has committed to spending between $60 billion and $65 billion in 2025 to bolster its AI infrastructure and expand its workforce in AI development. One of its flagship AI products, Meta AI, currently has approximately 700 million monthly active users, with executives projecting that number could surpass 1 billion by year’s end.

The company has steadily introduced generative AI advertising tools designed to enhance creativity and efficiency in digital marketing. More than 4 million advertisers have now adopted these tools, a dramatic increase from 1 million just six months ago. Among these offerings is Image Animation, Meta’s first video generation tool, which debuted in October. According to Li, “There has been significant early adoption of our first video generation tool, Image Animation, with hundreds of thousands of advertisers already using it monthly.”

Additionally, Advantage+ shopping campaigns, which are part of Meta’s broader AI-driven advertising suite, experienced 70% year-over-year growth in Q4. This surge in adoption highlights the effectiveness of AI in optimizing campaign performance, particularly during high-traffic shopping periods. These campaigns have now surpassed an annual revenue run rate of $20 billion. To further streamline access to AI-powered advertising, Meta is working to eliminate the need for advertisers to choose between manual and automated campaign management, allowing for a more seamless integration of AI-driven ad solutions.

The Road Ahead:

While familiar factors contributed to Meta’s strong Q4 advertising performance, the company’s future appears increasingly tied to its ambitious AI initiatives. The rapid adoption of generative AI tools suggests that Meta’s bet on artificial intelligence is resonating with advertisers seeking greater efficiency and automation in their marketing efforts.

However, questions remain about how brand safety concerns, regulatory scrutiny, and competition from emerging AI players will shape Meta’s trajectory in 2025. For now, the company’s ability to drive revenue through innovative AI applications and maintain its dominance in digital advertising appears intact, reinforcing its position as a leader in both social media and artificial intelligence development.

The article first appeared on marketingdive.

Validate your login

Sign In

Create New Account