Goldman Sachs is rolling out a generative AI assistant aimed at transforming the way its bankers, traders, and asset managers operate. This innovative program, dubbed GS AI Assistant, marks the initial stage in an ambitious initiative to create a tool that mimics the expertise and decision-making abilities of a seasoned Goldman employee. According to Chief Information Officer Marco Argenti, the AI assistant is designed to seamlessly integrate into the workflow of Goldman Sachs employees, making it feel like interacting with a knowledgeable colleague.

To date, approximately 10,000 employees have been granted access to the GS AI Assistant, with plans to extend its use to all knowledge workers within the firm by the end of the year. “The AI assistant becomes really like talking to another GS employee,” Argenti explained in an exclusive interview with CNBC. The assistant is currently capable of performing tasks such as summarizing emails, proofreading documents, and translating programming code between languages.

Simplifying Complex Tasks

“The goal is to put a variety of capabilities at the fingertips of our workforce,” Argenti said, emphasizing the program’s simplicity and accessibility. The assistant is powered by cutting-edge AI models, including OpenAI’s ChatGPT, Google’s Gemini, and Meta’s Llama, and can adapt to a wide range of tasks. Goldman Sachs is also evaluating additional models from providers such as Anthropic, Mistral, and Cohere to further enhance its AI ecosystem.

This strategic deployment aligns Goldman Sachs with other leading investment banks, including JPMorgan Chase and Morgan Stanley, which have embraced generative AI technology as a core element of their operations. The rapid adoption of generative AI across Wall Street underscores the transformative potential of large language models (LLMs), which excel at replicating aspects of human cognition and problem-solving.

A Vision for AI-Enhanced Workforces

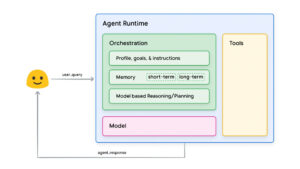

Argenti envisions the GS AI Assistant evolving from a tool for simple responses and summarizations to a sophisticated entity capable of autonomous decision-making and task execution. He likens the AI’s development to the onboarding of a new employee who gradually absorbs the firm’s culture, values, and knowledge base.

“As we progress, the second step is when the AI starts exhibiting agentic behavior,” Argenti explained. “It won’t just provide answers like a Goldman employee; it will begin completing tasks and making decisions in line with Goldman’s methodologies.”

Goldman Sachs, like other firms, has opted to develop proprietary AI platforms rather than relying on external tools such as ChatGPT. This approach not only ensures data security but also enables the creation of AI systems that reflect the firm’s unique identity and operational standards.

“For the AI to have a very specific identity that mirrors the values, knowledge, and problem-solving approaches of our firm is extremely important,” Argenti noted. The AI will eventually adopt best practices inherent to Goldman employees, such as cross-referencing data sources and selecting optimal algorithms for financial calculations.

The Future of AI at Goldman

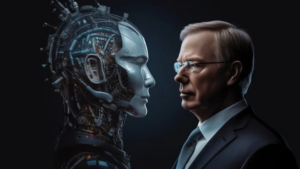

Over the next three to five years, Argenti anticipates that the GS AI Assistant will achieve new levels of sophistication, blurring the line between human and machine reasoning. Future iterations of the AI are expected to generate complex strategies and detailed operational plans akin to those devised by experienced Goldman professionals.

“This AI will reason and think more like a Goldman employee,” Argenti said. “Instead of being handed a rigid set of instructions, it will independently craft actionable plans and solutions.”

Navigating the Challenges of AI Integration

While the deployment of generative AI tools holds immense potential, it also raises concerns about job displacement. Financial institutions, including Goldman Sachs, JPMorgan Chase, and Morgan Stanley, are rapidly introducing these technologies to their entire workforces. At JPMorgan, over 200,000 employees already have access to in-house AI tools, while Morgan Stanley provided AI capabilities to approximately 40,000 employees by the end of 2023.

Despite the excitement surrounding AI, a Bloomberg report projects that global investment banks may shed up to 200,000 jobs in the next three to five years as AI takes over back-office and operational roles. However, Goldman Sachs remains committed to empowering its employees rather than replacing them.

“The importance of having a phenomenal human workforce is actually going to be amplified,” Argenti stated. He emphasized that people will remain central to the firm’s success by educating, refining, and collaborating with AI systems.

A Collaborative Future

Ultimately, Argenti believes that the integration of AI will enhance human productivity and creativity rather than diminish the role of people in the workplace. “In my opinion, it always boils down to people,” he said. “People are the ones who evolve, educate, and empower AI. They’re also the ones who will take decisive action.”

As Goldman Sachs and other Wall Street giants continue to innovate with generative AI, the technology promises to redefine the financial industry. With its ability to augment human expertise and drive efficiency, the GS AI Assistant exemplifies the potential for AI to act not as a replacement for employees, but as a powerful collaborator in the pursuit of excellence.

Validate your login

Sign In

Create New Account